Financial Management Tips for Freelancers

Let’s cut to the chase on financial management for freelancers.

Below are 8 financial tips for freelancers. They’re all valid tips. They all sound good. But because your finances are so personal to your current situation, some of them may not apply to you today. Maybe they will some time, maybe never.

My suggestion? Review the tips. Find any that you can use right now. Get a start on implementing them. Consider others for “future planning”.

Build a 3- to 6-Month Emergency Fund

This tip can be tough to accept if you currently need every dollar to pay expenses. However, assuming your freelancing will grow, it’s excellent advice.

You already know that freelancing income is uneven. So, make it a goal to accumulate a cushion of at least 3 to 6 months of living expenses.

Put it into a savings account where you should earn at least a little interest (better than nothing).

Where do you start on this? See the next tip…

Pay Yourself First to Save

Aim to save a percentage of every payment you receive.

Open a separate savings account. Then, treat your savings as a non-negotiable expense, just like rent or utilities.

I can already hear you protest, “But how? That’s impossible. I need every cent.”

Let’s say your goal is to set aside 10% of all income to build your emergency fund. Imagine you got paid $500 for a recent project. That means, before you do anything else with that money, you take $50 off the top, and put it into your savings account.

Do a little mental jujitsu and lie to yourself. Tell yourself you only got paid $450 for that job. You have to pretend the $50 you’re saving doesn’t exist. It’s not there for you. It’s locked into your savings account and you don’t have the key.

If you try to save “what’s left over”, you’ll never save. You have to pay yourself first.

Separate Your Business and Personal Finances

Here’s another mind trick you have to master. As a freelancer, you’re running a business. Even if you’re an unincorporated solo freelancer, you still have a business.

Think of yourself and your business as two different entities.

Then open a separate checking account for your business. Note, from a banking perspective, it can still be a “personal account” which usually has far lower banking fees than the bank’s “business account”.

So, what you want are two personal checking accounts, one you call business, the other you call personal, and one savings account. Three accounts in all.

When a client pays you, let’s say $500, deposit the payment into your business account. Immediately transfer 10% (or whatever you decided), into your savings account.

Use Your Business Account to Plan for Taxes

Do you know your tax rate? Generally, it’s around 25% to 30% of your income. So, to go back to the $500 example, let’s take 25% or $125 for taxes. Leave that in your business account. Also, use your business account for expenses that you know you’ll write off your taxes.

That leaves you $500 - $50 savings - $125 taxes = $325 to pay yourself.

In theory, you could take that $325 and move it to your personal account.

But first, read the next tip…

Pay Yourself a Fixed "Salary"

Rather than spending all your income as you get it, set a fixed amount to pay yourself each month. This smooths out the highs and lows of freelance income.

Again, nice advice, which may or may not be practical in your case.

But as tempting as it is to “grab all the cash” when you get it, you really should try to smooth out your payments to yourself.

Depending on your total income, try to come up with an amount that you can comfortably pay yourself. Pretend you’re an employee of your business and you get paid every two weeks.

By separating you from your business, you start to break the feast or famine cycle so common in freelancing.

Track Expenses For Tax Deductions

Figure out a way to track all expenses—this will help with budgeting and tax deductions. You can set up a simple spreadsheet or use accounting software.

Just be sure you keep good records, and most importantly, receipts for everything related to your business.

From a budgeting perspective, you’ll know you have regular monthly expenses against your business. This could include software subscriptions, Internet access, and your monthly phone bill. You have to include these expenses before you pay yourself.

Learn more about tax write-offs for freelancers and how an accountant can help you sort it out here.

How to Improve Your Cash Flow

Cash flow is just a fancy term for money coming in and money going out. You need to keep an eye on this to be able to budget.

Most freelancers will be very aware of what they have in the bank and any outstanding receivables.

There are many ways you can improve cash flow from your existing clients.

The most obvious way to improve cash flow is to charge more. Could you charge more? Read about how much freelance copywriters or designers could charge for their work.

Another way to charge more is to write more detailed estimates. Many freelancers do a lot of “free work” that they could charge for. Why does that happen? They write inadequate estimates.

Here’s how you can increase your billing by writing detailed estimates for your projects.

Another way to improve your cash flow is to get deposits from clients. If you’ve never gotten deposits for your work, it just means you haven’t asked. Could you get them from your existing clients? Probably, yes. Read how these freelancers get deposits from their clients.

Deposits are just one item that should be included in your Terms & Conditions. Here’s what else goes into Terms & Conditions for freelancers.

Every Financial Planner Will Tell You to Invest in Your Retirement

And you should. Just like your separate savings account, you should open a retirement savings account. Generally, there are tax benefits for contributing to these types of accounts. The sooner you start, the sooner you can take advantage of either interest rates or the stock market, depending on how your savings account is managed.

However, don’t mistake this account for your cushion savings account. They’re two different accounts. Once you put money into a retirement savings account, you can’t withdraw it without paying taxes on it immediately. This account is really there for your retirement.

Take the time to learn how retirement savings accounts work in your country.

New Book For Freelancers

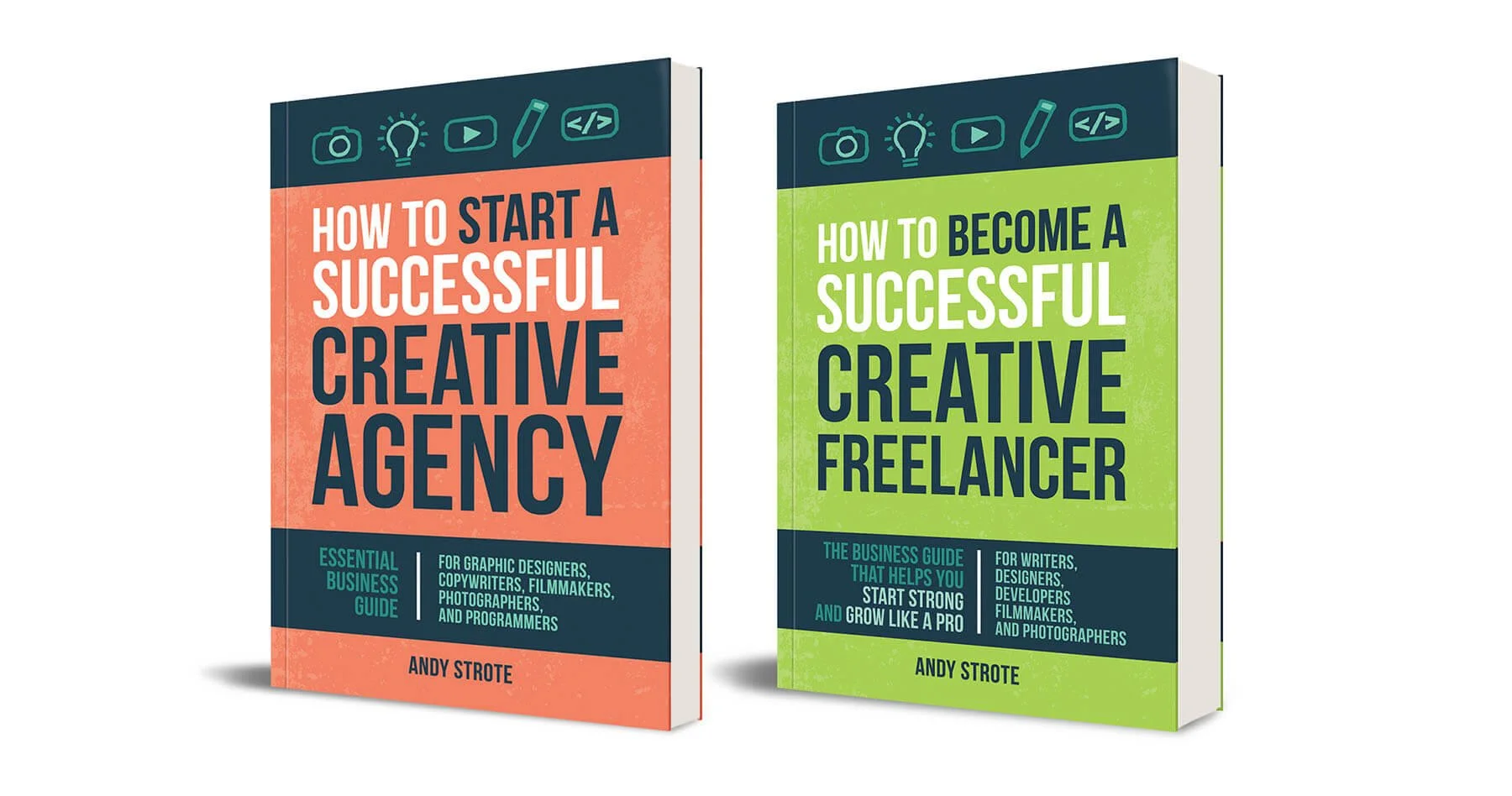

I’ve just published How to Become a Successful Creative Freelancer. It’s the essential business guide for freelance writers, designers, developers, filmmakers, and photographers.

Whether you’re just starting as a freelancer or have years of experience, you’ll learn a lot from this book.

It’s broken down into easy-to-understand chapters with strategies and tips you can use today. Not just “what to do”, but also “how to do it”.

It’s now available in Kindle ebook and paperback format on Amazon.

Want to Grow An Agency? The Agency Book is For You

If you’re looking for tips on how to build and grow your agency, you’ll want to read How to Start a Successful Creative Agency.

Available at Amazon (Paper & Kindle), Kobo (ebook), Apple Books (ebook), and Gumroad (PDF).

The book is packed with useful information to help creatives start and grow their business.

Testimonial: I Love the Approach

“Purchased your book earlier today, two chapters in and I have no regrets.

Excited to read the rest over the weekend

I love the approach and honesty…”

Pascaline K, on Twitter

Want a Free Taste First?

Sure! Sign up in the footer below for a free PDF of Chapter 14 of the Agency book, Working With Clients.

This chapter covers essential areas such as Clients vs. Projects, Corporate Clients vs. Small Business Clients, How to Create an Opportunity Document, Benefits of Finding a Niche… and much more.

Questions?

If you’re on Bluesky, I’m @strotebook.bsky.social. Ask me anything.

On Twitter, I’m @StroteBook. D.M.s are always open.

On LinkedIn, I’m Andy Strote. Ask away.